If we could all manage to shell out over the minimal transaction and give up stuff from my life we actually need, drowning in debts wouldn’t be considered a problem. Sadly, the majority of us are dwelling from paycheck to paycheck, and bad credit is a actuality which we must experience head on. Within the post beneath, you’ll locate some terrific tips about how to get rid of that credit pit.

The lowest credit card settlement is just not all you are able pay out, try and spend more than that amount. Paying out more than the lowest obligations looks exceptional over a credit report and may contribute to a greater FICO report. It also helps your money by reducing the amount of appeal to you are spending which could save you dollars.

The lowest credit card settlement is just not all you are able pay out, try and spend more than that amount. Paying out more than the lowest obligations looks exceptional over a credit report and may contribute to a greater FICO report. It also helps your money by reducing the amount of appeal to you are spending which could save you dollars.

Open up and look after about two to four diverse charge cards. It’s attractive to make use of less, but it may need a whole lot longer to rebuild your credit history with only one accounts. Using over 4 cards makes the effect that you just aren’t managing your debt effectively. Keep your amounts low on each of the balances and maintain them compensated by the due date.

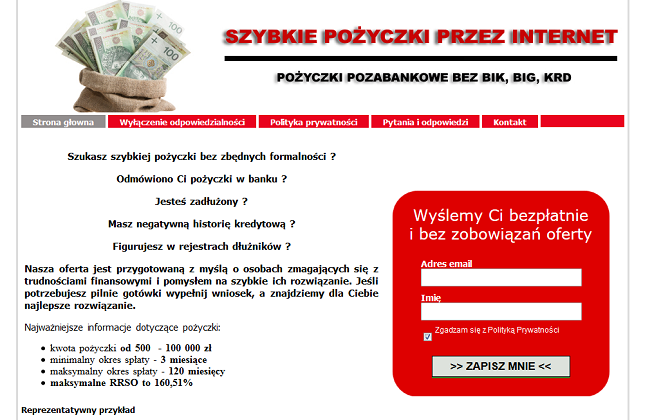

For those who have almost any issues concerning in which as well as the way to work with pożyczki pozabankowe przez internet, it is possible to call us with the web-page. Nothing will maintenance your credit score aside from time. For those who have delayed obligations, defaults and even individual bankruptcy, your rating will go down. There is no way to take away these as soon as they have been documented. Only some time and great actions could eventually cause them to less of any figuring out element in your credit score as well as the credit score that you receive.

If you wish to tournament a credit history bureau’s selection, you need to organize on your own. Distribute your assert in the output deadlines and make certain to go by up in case they are doing not behave quickly. Hire a lawyer that will help you through this method if you can pay for it. You need to regularly get in touch with the credit rating bureau regularly regarding your question.

Stay away from Payday cash loans. They have the greatest monthly interest of the personal loan you will get. When you can’t spend promptly, you will literally be digging your self into a golf hole that you can’t get rid of, as being the charges and interest rates continuously climb.

An essential idea to consider when working to restoration your credit history would be to always look at credit rating counselling before making any radical judgements. This is very important simply because you possibly will not know what is always good for you in fact it is often advisable to let it rest around the professionals. There are lots of free and authorities provided debt therapy organizations.

An important hint to take into consideration when working restoring your credit rating is to make sure that everything in your commitment is composed downward and agreed upon. This goes for just about any credit rating restoration financial transaction or any deal with the lender. This is significant since you can by no means believe – simply because some thing was mentioned face-to-face or over the telephone – it really is binding.

If you are seeking to repair your credit history after getting pressured right into a a bankruptcy proceeding, be sure all your financial debt from the personal bankruptcy is correctly noted on your credit score. Whilst using a financial debt dissolved due to bankruptcy is tough in your credit score, you need to do want lenders to find out those merchandise is no more inside your recent debt pool.

A vital tip to take into consideration when endeavoring to maintenance your credit rating, is the fact that you are unable to legitimately possess a 2nd credit rating data file made for you. This is significant to learn because there are sammers who supply to achieve this, in fact it is fully against the law. You can only have 1 societal security quantity and one taxes ID.

A significant suggestion to take into consideration when working to repair your credit would be to consider paying off your cards which are closest with their boundaries very first. This is very important simply because possessing bank cards around their greatest restriction is toxic for your credit rating. Consider dispersing the debt between your other cards or concentrating on this card initially. This process may not benefit anyone.

A vital tip to consider when trying to fix your credit rating is to not have too many installment lending options on your report. This will be significant since credit rating companies see organized transaction as not showing as much responsibility as a financial loan that permits you to create your own payments. This might decrease your rating.

The first step for taking when you are seeking to maintenance your credit history is to ask for the yearly, no-expense duplicate of your credit report. Considering that your credit score contains all the information which is used to tabulate your credit history, trawl it tightly for just about any faults. Spend certain awareness of the studies recently payments and be sure that the volume of debts shown for every single open account is appropriate. Should you place any improper information on your credit score, challenge these errors using the confirming agency along with the credit rating bureau.

Don’t build-up any new debts. This method for you to center on paying off outstanding debts that you simply presently are obligated to pay. When you acquire new obligations, it can make paying off other ones harder. Should you have to use credit cards to get a acquire, be sure to pay it off 100 % in order to avoid fascination service fees.

To operate on increasing your credit history, make sure you pay out all of your current utility bills promptly. Power firms will often submit judgement making towards you when you are not producing typical punctually payments. These will damage your credit rating just like awful as a credit card delayed settlement will.

Review your credit report for outstanding debts and discrepancies. Commence the process of fixing your credit history by checking your credit score to discover what negative stuff you have on there, and comparing this with your personal information. Label any details that may be inaccurate and question it by getting in contact with the credit rating firm. They will allow you to fix any information and facts that is certainly improper. The truth is, they are obliged by law to do so.

There’s anything to get stated about resiliency. It reveals incredible figure. In fact most people with bad credit are trying hard to get from it, and this reveals an unbelievable amount of resiliency. Utilize this advice here and keep on preventing the great overcome. Go out from under that credit score cloud and clear your own name.